Deputy Speaker Orders Guma to discontinue Water Supply to All MDAs …For Failure to pay accrued water bills

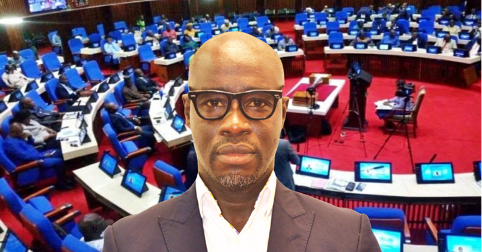

Deputy Speaker of Parliament who doubles as Chairman for Public Account Committee, Hon. Ibrahim Tawa Conteh, has instructed Guma Valley Water Company to immediately discontinue water supply to all government Ministries, Departments, and Agencies (MDAs) within 48 hours, citing their failure to pay accrued water rate bills.

This announcement was made during a committee hearing held at the Administrative Building in Parliament Tower Hill, Freetown, where representatives from Guma Valley Water Company were brought to account for the alarming situation regarding unpaid water bills.

The backdrop to this urgent directive is rooted in a detailed examination of the Auditor General’s ledger report, which uncovered significant debts owed by Guma Valley Water Company in the form of withholding taxes amounting to Le 1,617,597.26 and Pay As You Earn (PAYE) taxes that have not been remitted to the National Revenue Authority (NRA), totaling Le 17,153,696.46.

A representative from Guma Valley Water Company attributed the company’s current financial strain to its inability to generate sufficient revenue from its customers, particularly the MDAs across the country. This steep decline in revenue collection has resulted in a vicious cycle of noncompliance with tax obligations and mounting debt.

Addressing a packed room filled with lawmakers and Guma officials, Hon. Conteh expressed his frustration over the reckless disregard shown by various ministries towards their responsibilities to pay water bills. He emphasized that the repercussions of these unpaid bills extend beyond mere inconvenience; they impede governmental operations and slow down essential services, ultimately affecting the state’s ability to function effectively.

Among the ministries identified as owing substantial amounts in water rate bills are prominent institutions such as the Sierra Leone Parliament itself, the Youyi Building which houses multiple ministries and the Ministry of Defence, alongside the Ministry of Tourism and Cultural Affairs. The situation exemplifies a systemic failure that Hon. Conteh argued must corrected immediately.

“Guma must notify these ministries and cut off their water supply within 48 hours if they do not comply with their payment obligations,” he instructed. “The Youyi Building in particular is a point of concern. It hosts numerous ministries that are using government assets freely without fulfilling their commitments. This cannot continue,” he added, reiterating the importance of accountability among government agencies.

The Chairman of the PAC laid special emphasis on the cascading effects of this noncompliance, warning that such behavior not only hampers the individual departments from carrying out their functions effectively but also hinders the government’s overall capacity to generate revenue needed to run the country’s affairs. “It is irresponsible for ministries to ignore their financial obligations while expecting uninterrupted services. They are jeopardizing the government’s ability to provide for its citizens,” he said.

Lahai Kanu, a representative from Guma Valley Water Company, echoed the sentiments expressed by Hon. Conteh, presenting the company’s own challenges in light of the ongoing crisis. Kanu articulated two clear options available to the ministries: either they settle their outstanding water rate bills or face an immediate cut-off in their water supply. He emphasized that compliance was not just necessary, it was imperative for the sustainability of services provided by Guma Valley Water.

This directive does not print in isolation; it reflects a broader narrative of fiscal responsibility within Sierra Leone’s governmental framework. The governmental framework. The lack of accountability seen in government agencies raises serious questions concerning governance and resource management, which have consistently been issues of concern in the nation. The public accounts committee under Hon. Conteh’s leadership aims to instill a culture of compliance among ministries and reinforce the expectation that government entities adhere to their financial commitments.